New Features

Payroll Process - Social Security

When the weekly wage for an employee is changed the Employee and Employer share are automatically updated. This way the user can now just change the Weekly Wage and the shares are calculated according to the local Social Security rates.

Updates

Payslip Updates

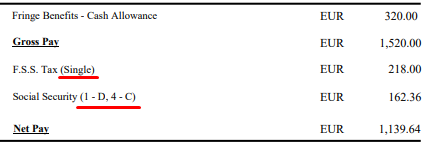

- Removed C4 from the “To Date“ section, as it might be confused with the Gross Pay. C4 is omits cash allowance, hence does not tally with Gross Pay.

- Added the Taxation Method, such as Single, Parent, Married or other next to F.S.S.

- Added the number of Contributions, next to S.S.C. in the case where the SSC category changes within the period, the number of contributions paid at each category are shown.

- Add a new Company specific flag “Print Payslip Leave Summary“. When selected, the leave summary is shown in the payslip. When unselected the leave summary will be hidden from the payslip.

Payroll Process Updates

- When a period is closed, the system will check the Net Pay for each employee. In the case of employees with a Net Pay of 0, the user will be asked whether to include these employees or not.

- A further update has been made, so that when the Net Pay is 0, the values for the F.S.S. and Social Security Contributions are removed.

Following the Unpaid Leave and Sick Leave feature, a further update has been made, so that such missing work days are removed from the Government Bonus. - The quick process has been optimized so that already processed employees are not re-processed. This way, re-entry to a payroll process will be quicker.

- Basic hours for Payable by the Hour employees will be regarded as Basic Wage. These are then used to calculate the Social Security and F.S.S.

- Alphabetically sorted the list of Available Payment Types in Salary Details

- Sorted the already tied payment types according to the amount.

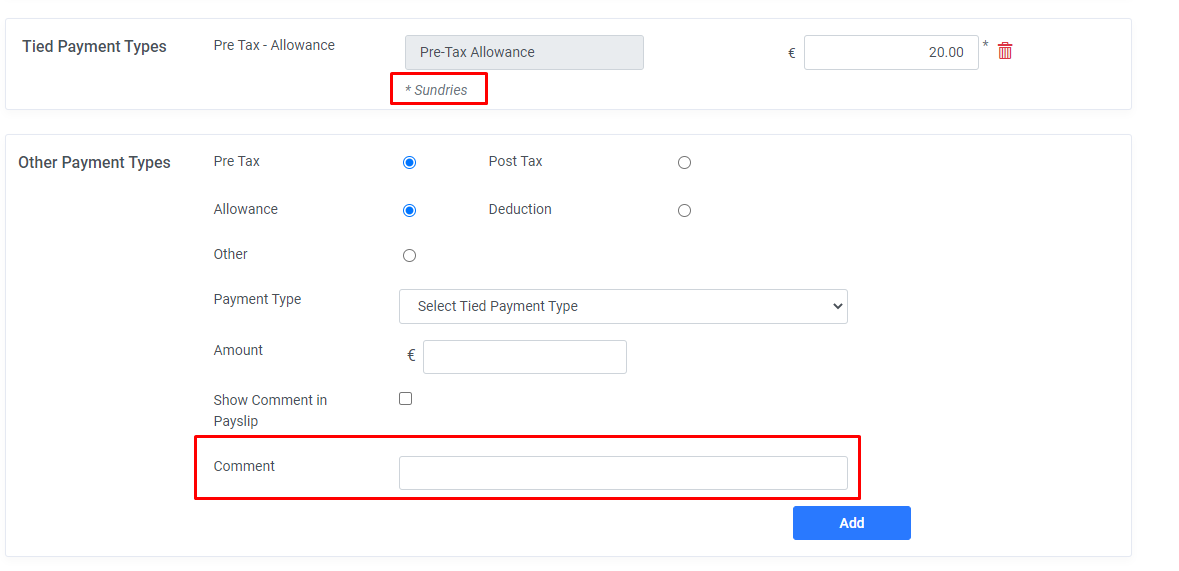

- Added a field to Other Payment Types so that the user can now insert a comment. When “Show Comment in Payslip” the comment will be shown in the payslip.

Bug Fixes

Minor Fixes

- Changed the Employment Start date in the Employee list, so that it shows as Day/Month/Year (DD/MM/YYYY).

- The Company Totals Report has been so that it has quicker generation.

- Updated the Payroll Data Summary Report, so that the Reference Code and employee name and surname are aligned.

- In SEPA file builder, only multiple files are zipped. Single files are downloaded as PDF files, or password protected PDF Files.